A guide to UK duty hikes on wine

Posted by Gavin Quinney on 30th Jun 2023

We should be full of the joys of summer and the healthy state of the vines after a successful flowering. This newsletter, however, focuses on the upcoming increase in UK duty on wine from 1 August, as it has slipped below most people’s radar.

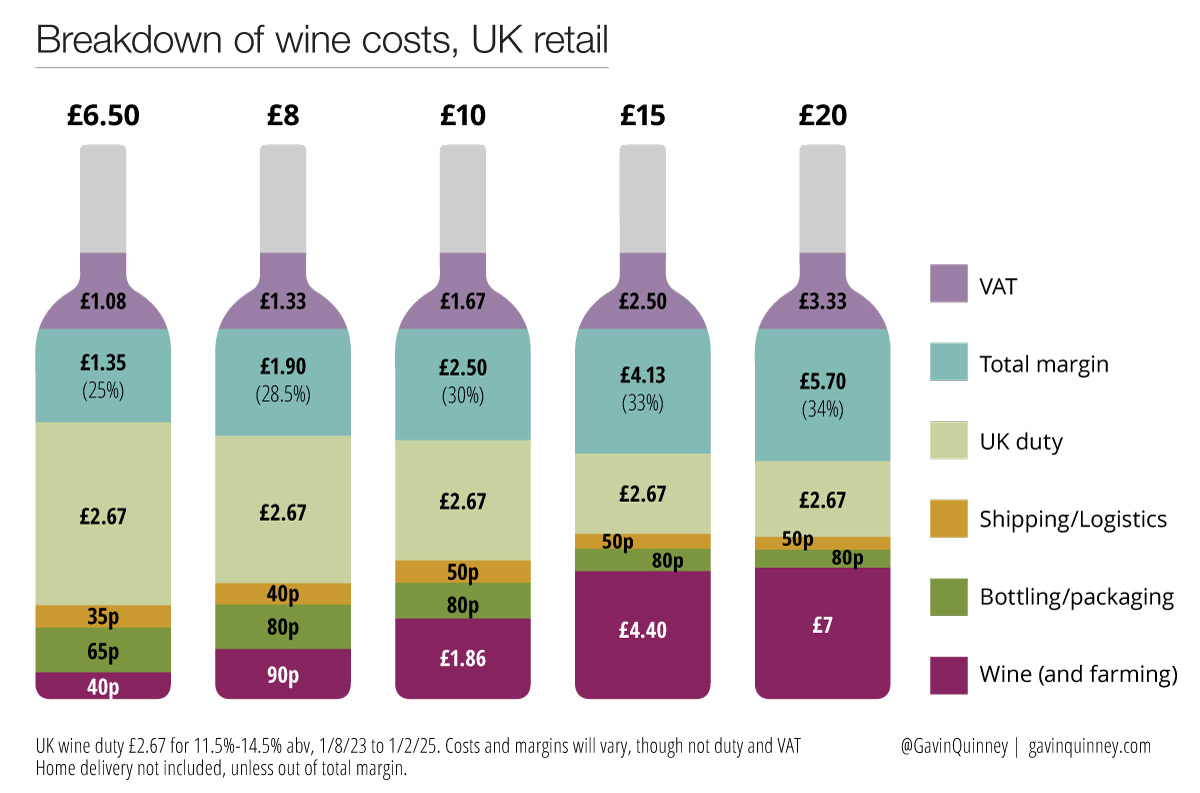

An increase of 53p a bottle might not seem much to some but with 50% of an £8 bottle of wine soon to be UK tax, it’s worth considering how much is spent on a bottle. And perhaps, more than ever, ‘drink less but better’ might be the message.

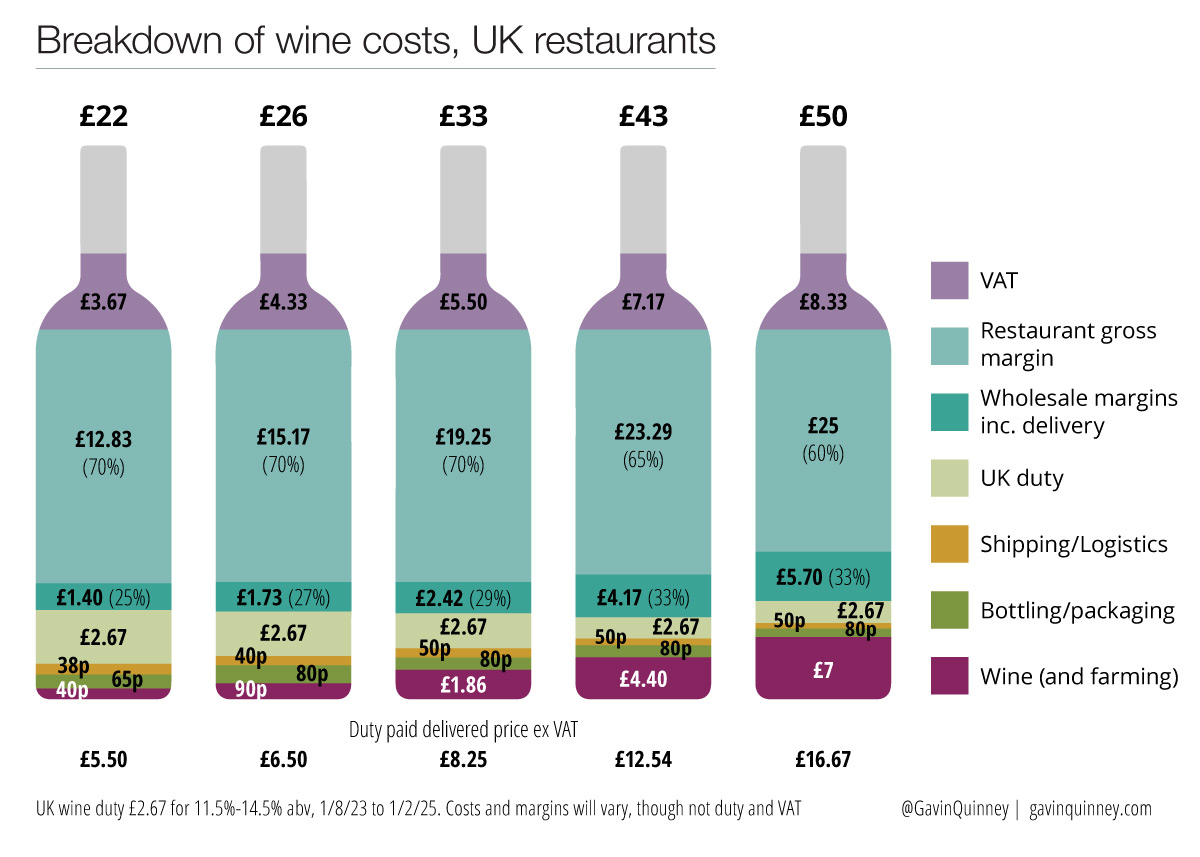

We’ve tried to make it easier to grasp with a fancy graphic of typically-priced bottles, above, and roughly where the money goes at each price point when you buy from larger retailers. And, in a separate picture, in restaurants.

There’s also an in-depth look at the data behind the duty on wine. We hope it’s of interest and, aside from perhaps sharing in our frustration, we’d like to think you’ll be better informed to make smart decisions when it comes to buying and enjoying the stuff.

In the meantime, we’ll be releasing a few special offers of our own in the coming week. For obvious reasons.

All the best

Gavin & Angela Quinney

UK wine duty rises on 1 August and beyond

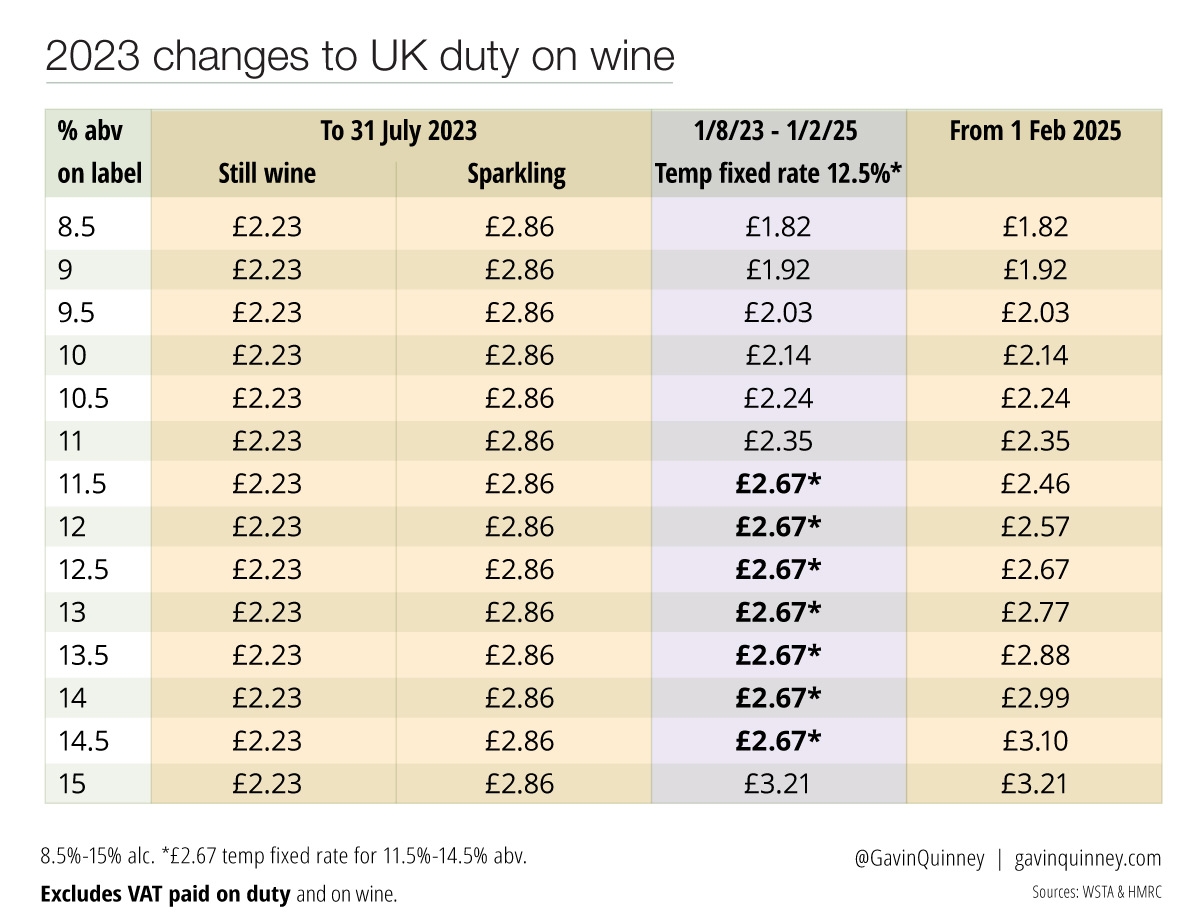

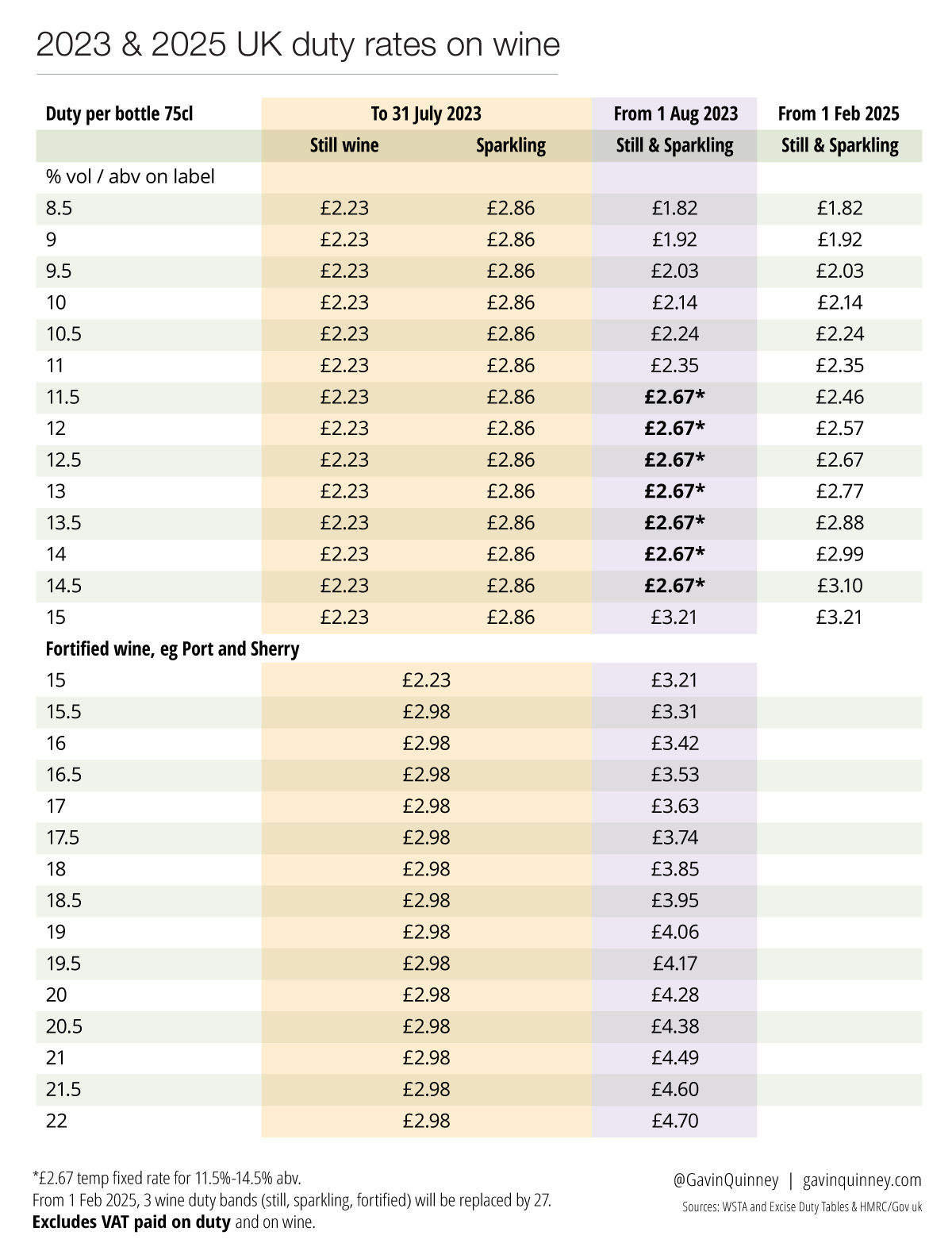

UK duty on still wine over 11% abv (alcohol by volume) is going up on 1 August 2023, with all still wine from 11.5% to 14.5% up by 44p a bottle, from £2.23 to £2.67 plus VAT. That’s a 20% increase, and the biggest duty hike since 1975.

There’s 20% VAT on the duty as well as the wine, so it’s a double whammy. So that 44p duty rise is really 53p, with duty at £2.67 costing £3.20.

On a £5 bottle of wine, £3.50 will be UK tax – not so long ago, that was the average price paid in a supermarket. That’s a mere 70% tax, in duty and VAT.

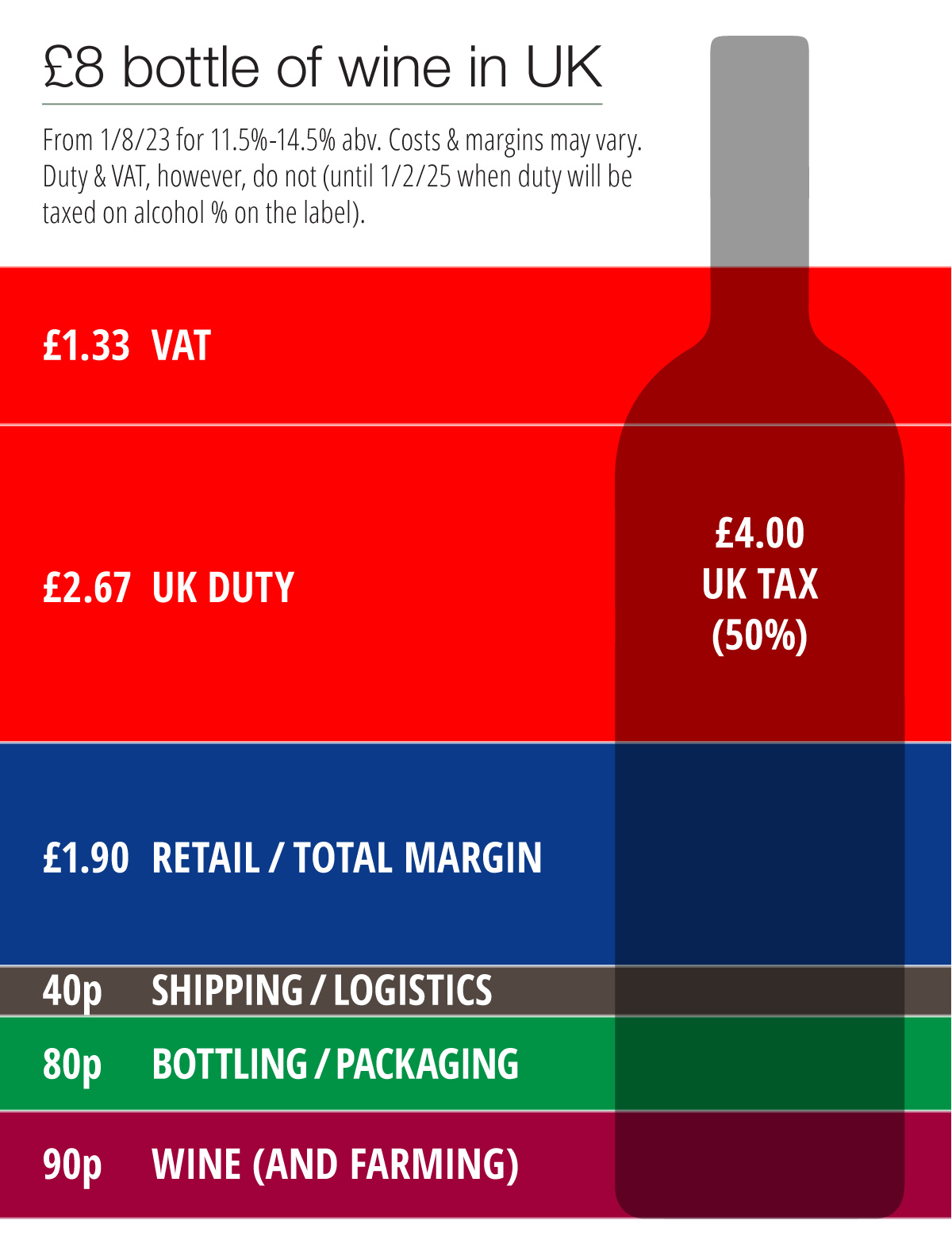

On a bottle costing £8 meanwhile, 50% is UK tax, made up of £2.67 duty and £1.33 VAT. That’s an easy number to remember, and might set the alarm bells ringing when you consider the £4 that’s left.

Here’s a straightforward graphic. Of course, one size doesn’t fit all and these figures are probably slanted more to bigger retailers than smaller independents. The ‘total margin’ used is 28.5% of the selling price of £6.67, plus VAT, and home delivery is not included in these numbers.

It’s hard to see how independent wine shops can sell a wine for £8 now. Note that I’ve also added ‘(and farming)’ after the cost of wine.

There is some good news, in that the duty on sparkling wine has come down from £2.86 a bottle to the same level as still wine. This 19p drop (to £2.67) might make a small difference to the price of cheaper proseccos, cavas or crémants but it is barely significant to English sparkling wine (or Champagne) at £25 and upwards a bottle. About 1 in 8 bottles of wine cleared by customs last year was sparkling.

The £2.67 duty figure for wines of 11.5%-14.5% (ie, the vast majority) is actually a stop gap, flat rate until 1 February 2025, when a new system of taxing wine on the labelled level of alcohol kicks in completely. Three simple bands of taxing wine currently – still wine, sparkling and fortified – will become 27, with different levels of duty for every 0.5%, in steps of around 10p duty per 0.5% vol.

Despite virtually the entire UK wine trade voicing its opposition to the scheme, the new system for charging duty is being implemented. To tax wine on the level of alcohol may sound simple enough but each and every vintage of the same wine could have a different level of alcohol – thanks to, ahem, the weather – from one year to the next. Many thanks to the scores of our customers who wrote to their MPs last February in response to the government’s request for feedback on the policy, but sadly nothing came of all our combined efforts.

Pass the Port, and quick

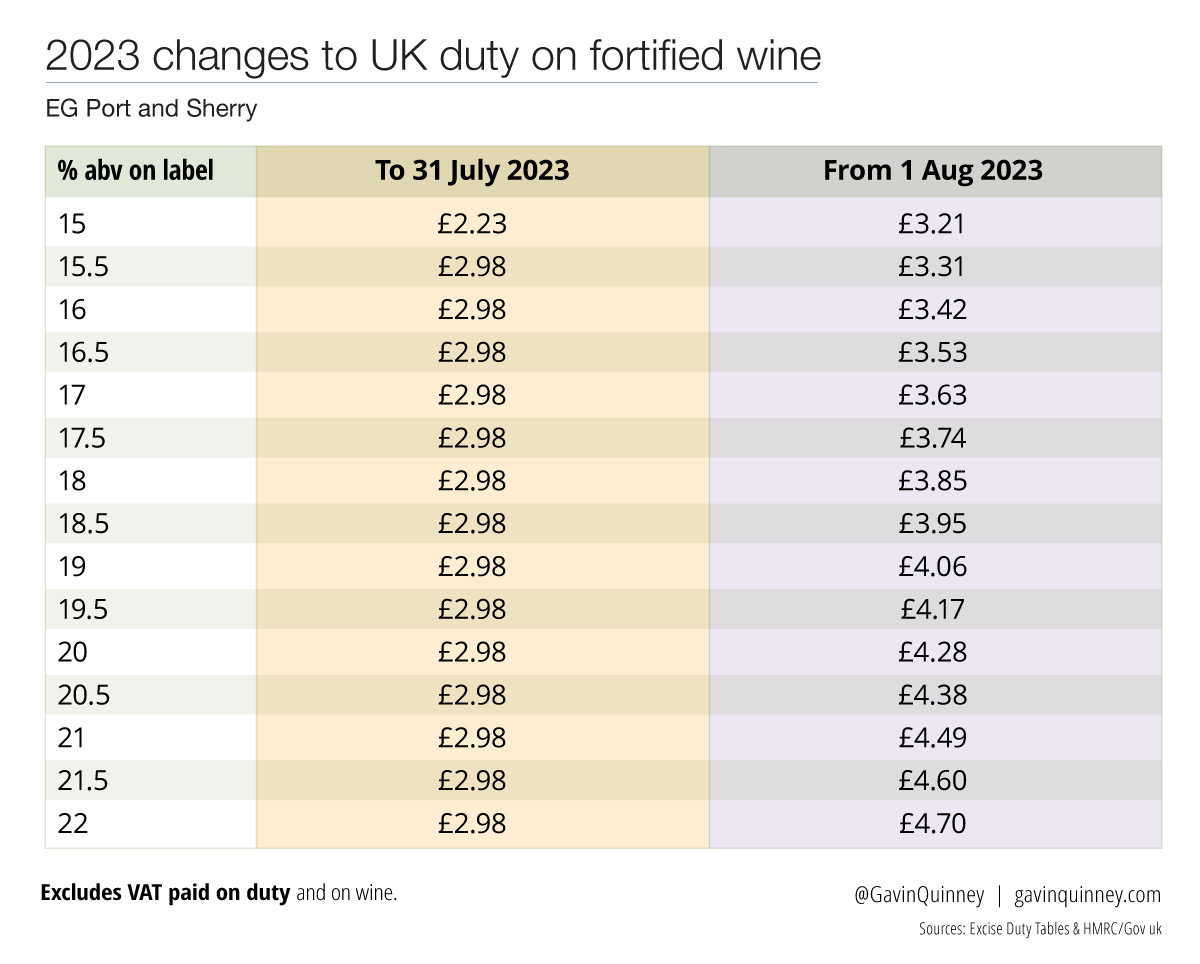

There is no ‘temporary easement’ or flat rate for wines of 15% abv and fortified wines, and the full weight of the new system for these kicks in from 1 August. Duty on still wine that’s labelled at 15% by volume will go from £2.23 to £3.21 plus VAT (!). Port and sherry will be especially hit, with a port of, say, 20% abv going from £2.98 duty to £4.28.

A rough guide to the impact of the new duty on wine

With this new level of duty, a small jump in the spend on a bottle should mean that you get more bang for your buck. Even more so than before. Note how the price of the wine inside the bottle doubles from one bottle to the next in line, at least for four of them.

Do though be aware of fake offers. Buy a wine that’s on a genuine offer, sure, and there’s bound to be a lot of current duty-paid stock in the system for a while. Longer term, do support your local or favourite wine merchant. (Or vineyard, obviously.) Small and medium-sized businesses are going to need all the support they can get.

All things being equal, your money goes a lot further with the cost of the wine at source when you spend over £10 compared to £8, and so on. That won’t guarantee you a better product but it could certainly help.

Buying wine in UK restaurants and pubs

I’ve used wines of a similar cost to the bottles above for comparison.

Restaurants usually buy wine at a price called ‘duty paid delivered’ or ‘dpd’. That’s the cost price to the on-trade, with VAT then on top. To achieve a 70% gross margin, which is what many would need as a minimum for wines at the cheaper end of the list, they would multiply that price by 4. That gives them the list price including VAT. Eg, a £6 wine at cost – to the door – would be £24 on the list. (£4 is VAT and at £20 they’re making 70% gross margin.)

Correspondingly, as a customer, I’d divide the list price by 4 and that gives you an idea of the cost price to the restaurant ex-VAT. Premium restaurants however, and those with higher costs, would seek to make 75% gross margin or more – for wines under, say, £40 on the list.

The impact of £2.67 duty as part of that cost, especially at the lower end, is huge.

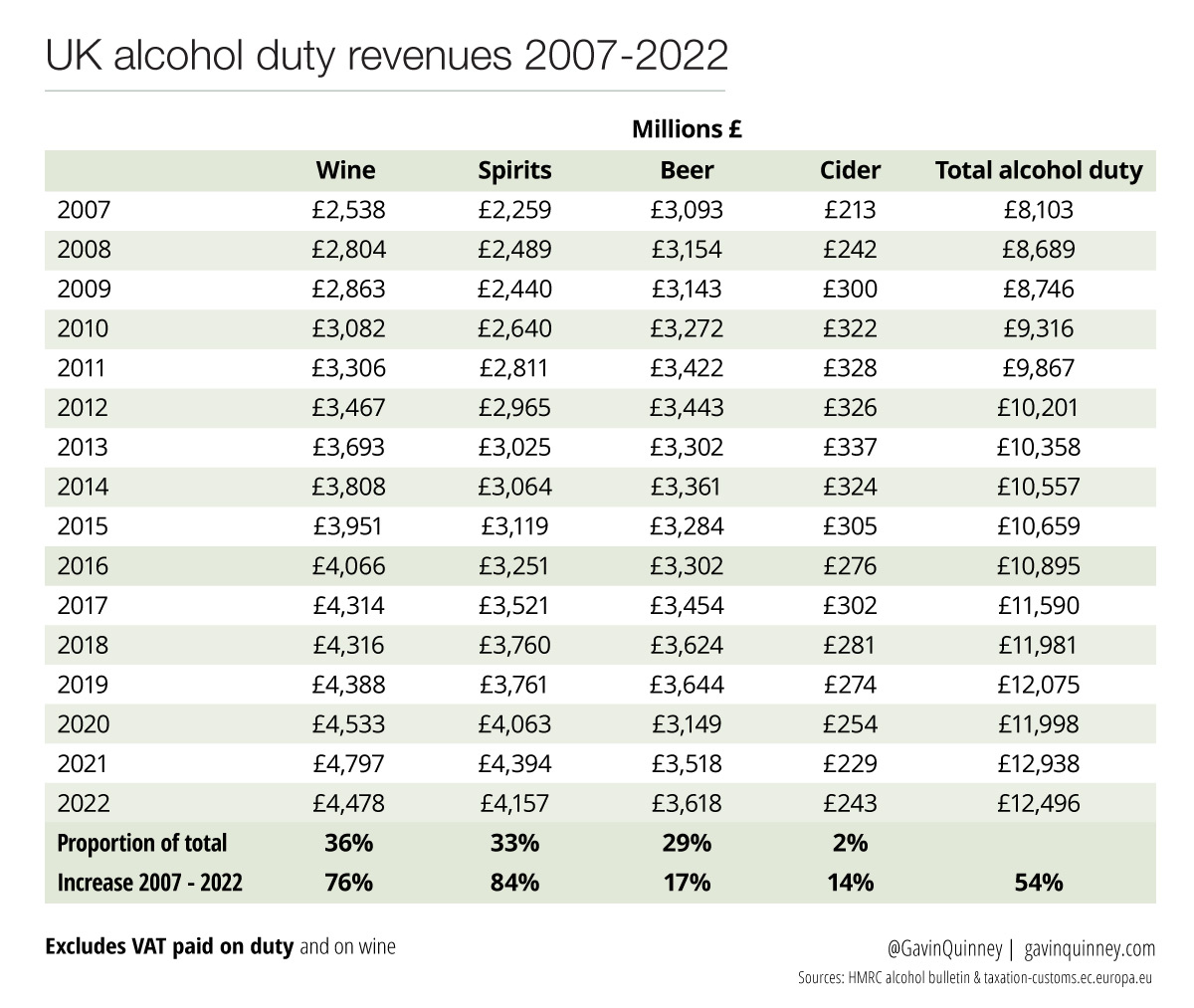

Wine duty and the enormous contribution to the Exchequer

What’s so frustrating about all this is that wine has a fantastic record of contributing hugely. It provides the most duty of all alcohol categories to the Exchequer, with £4.5 billion collected out of £12.5 billion in total alcohol duty in 2022, ahead of spirits (£4.2 bn) and beer (£3.6bn) – plus VAT.

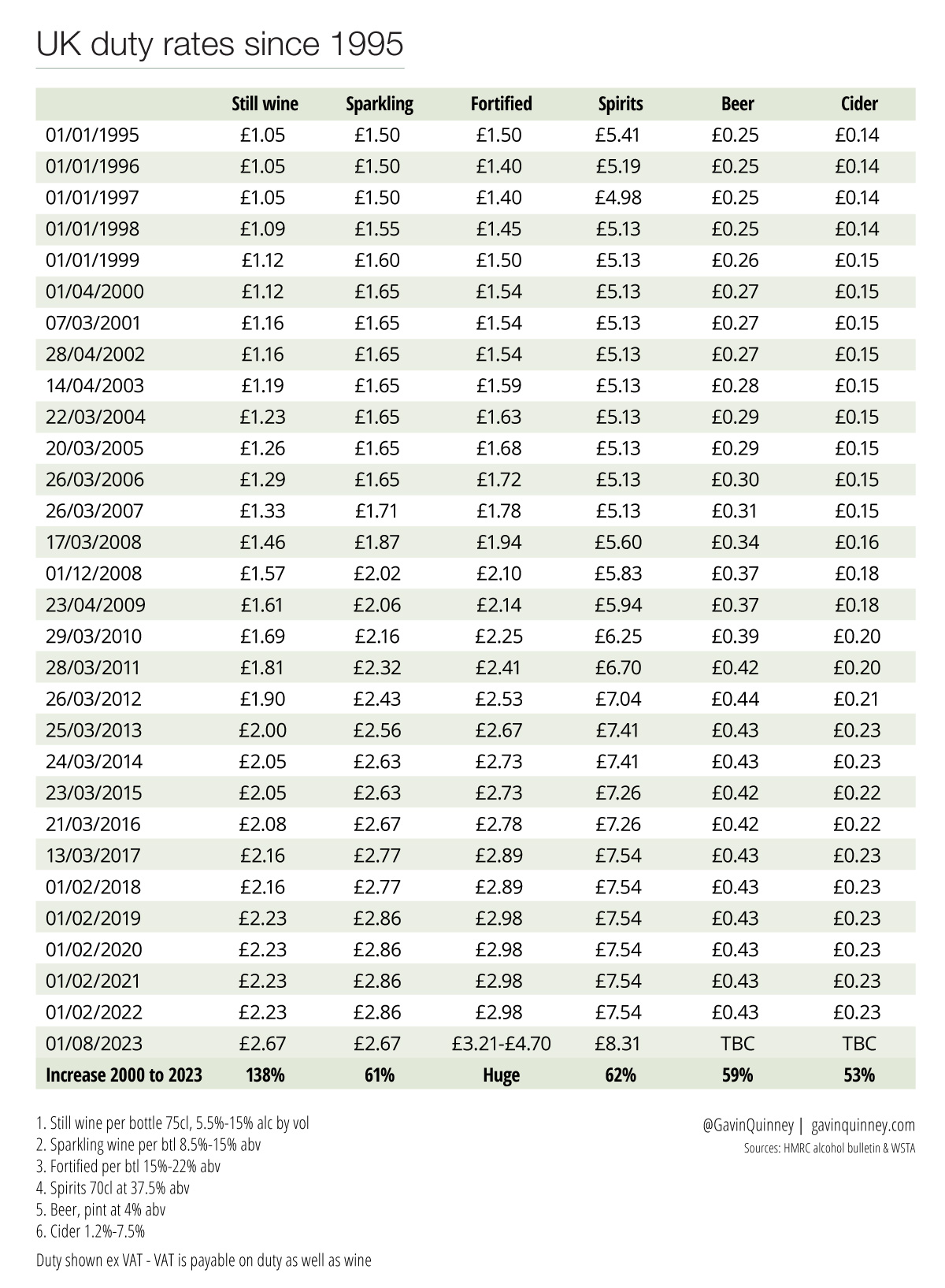

It wasn’t always that way – back in 2007, wine duty raised £2.5bn, beer £3.1bn and spirits £2.3bn. (See the appendix for the volumes of each.)

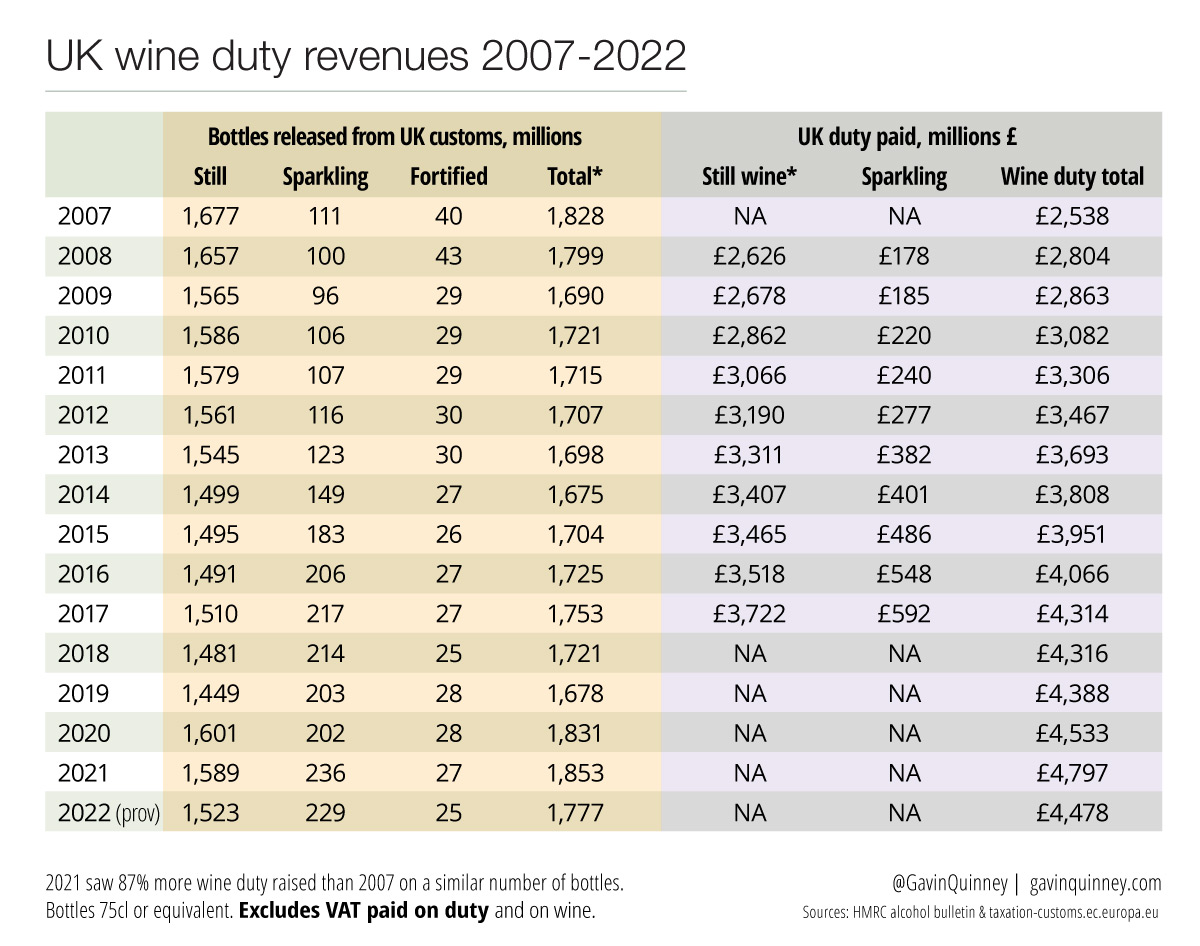

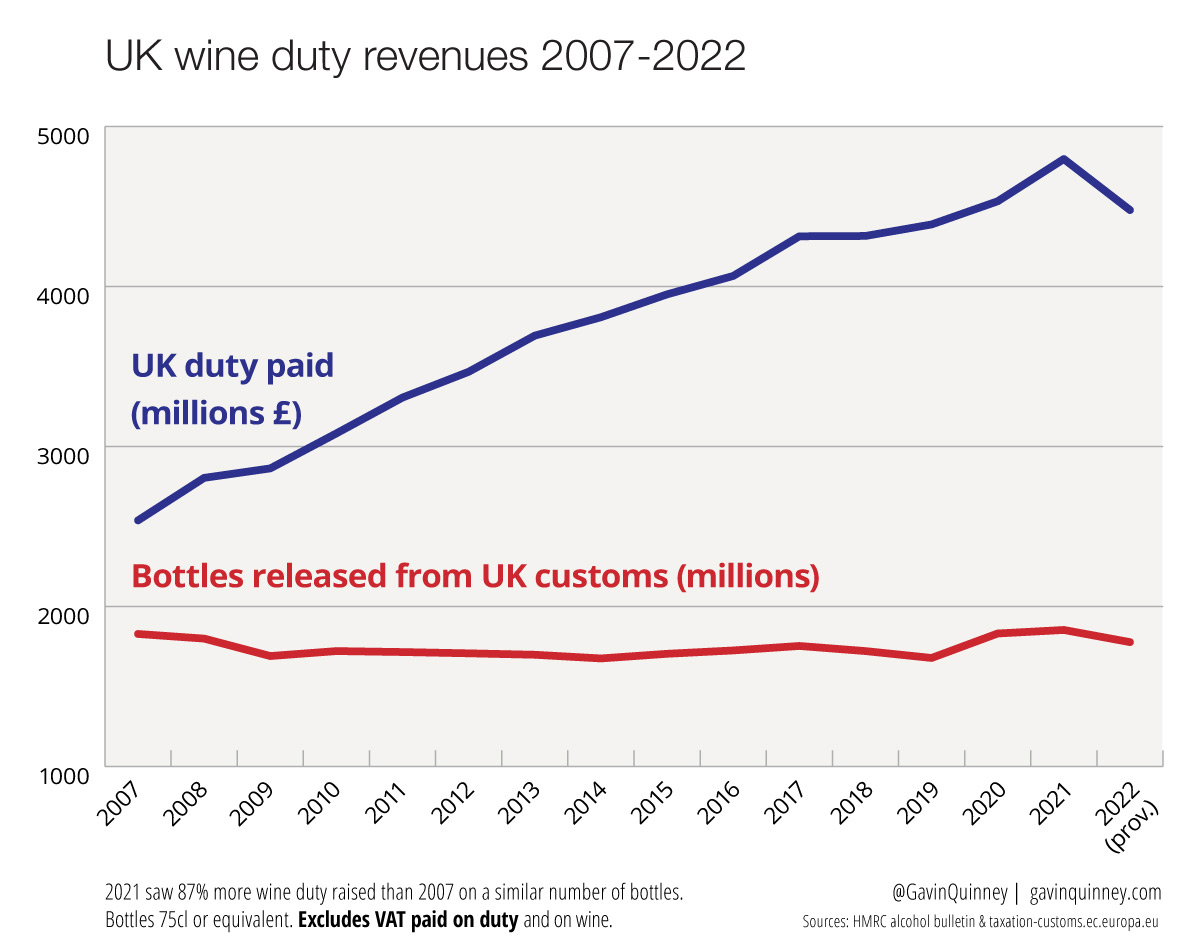

The amount of wine consumed in the UK (on which duty is paid) has been remarkably consistent over the last 15 years or so at around 1,750 million bottles, with ever increasing amounts of duty being raised. The highest figure was in 2021, during the pandemic, at 1,853 million bottles.

87% more wine duty was paid in 2021 (£4.8bn) than in 2007 (£2.5bn) on a similar number of bottles. If just inflation had been applied to the £2.5bn, the 2021 receipts would have been £4bn.

So why change a winning formula?

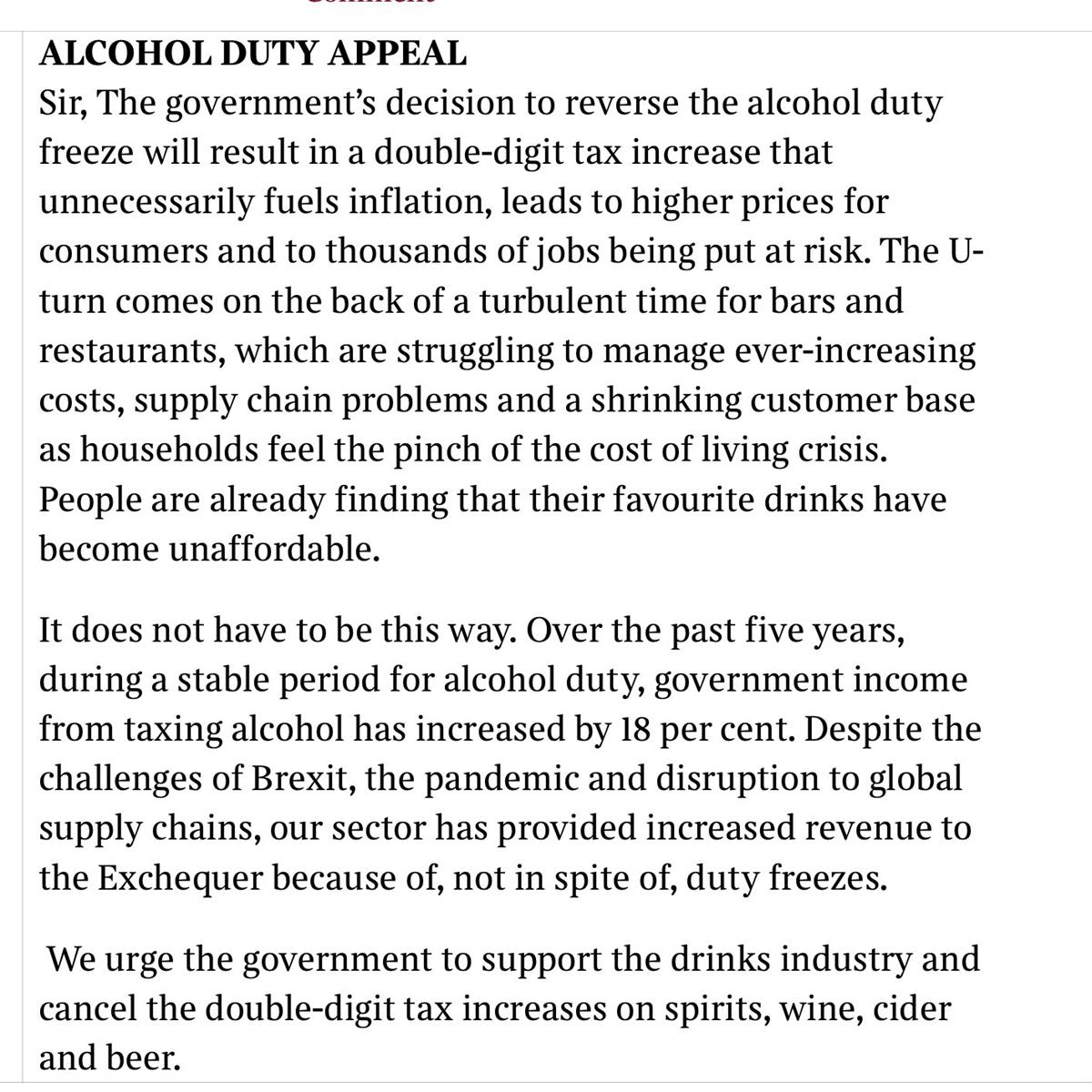

‘Over the past 5 years, during a stable period for alcohol duty, Government income from taxing alcohol has increased by 18%. Despite the challenges of Brexit, the pandemic and disruption to global supply chains, our sector has provided increased revenue to the Exchequer because of, not in spite of, duty freezes.’

That was from a letter to The Times by our friend Miles Beale, CEO of the Wine and Spirit Trade Association, on 15 November last year. We signed it along with numerous other members of the WSTA. ‘We urge the government to support the drinks industry and cancel the double-digit increases on spirits, wine, cider and beer.’

Unfortunately, nothing came of it – unless I’ve missed something.

The duty freeze from February 2019 onwards worked just fine, with record revenues for the Treasury.

Rishi’s Brexit benefit

‘What’s important now is that we deliver on the benefits of Brexit. And just to give you some examples of things I’ve been doing: we’re creating freeports in places like Teeside, which brings jobs and investment there, and we’re reforming the system of taxation for alcohol duties.’ Rishi Sunak on ITV, 17 July 2022.

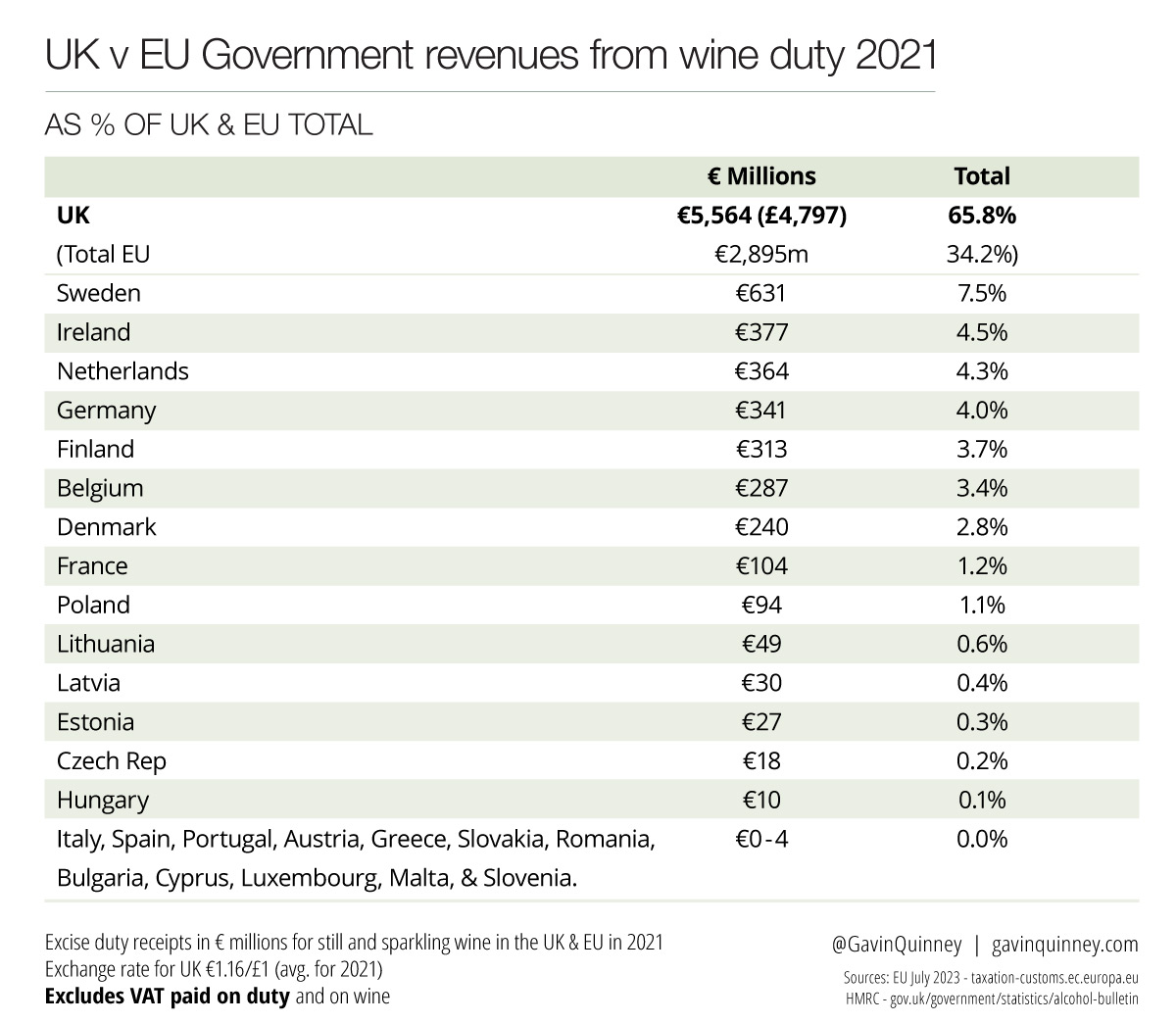

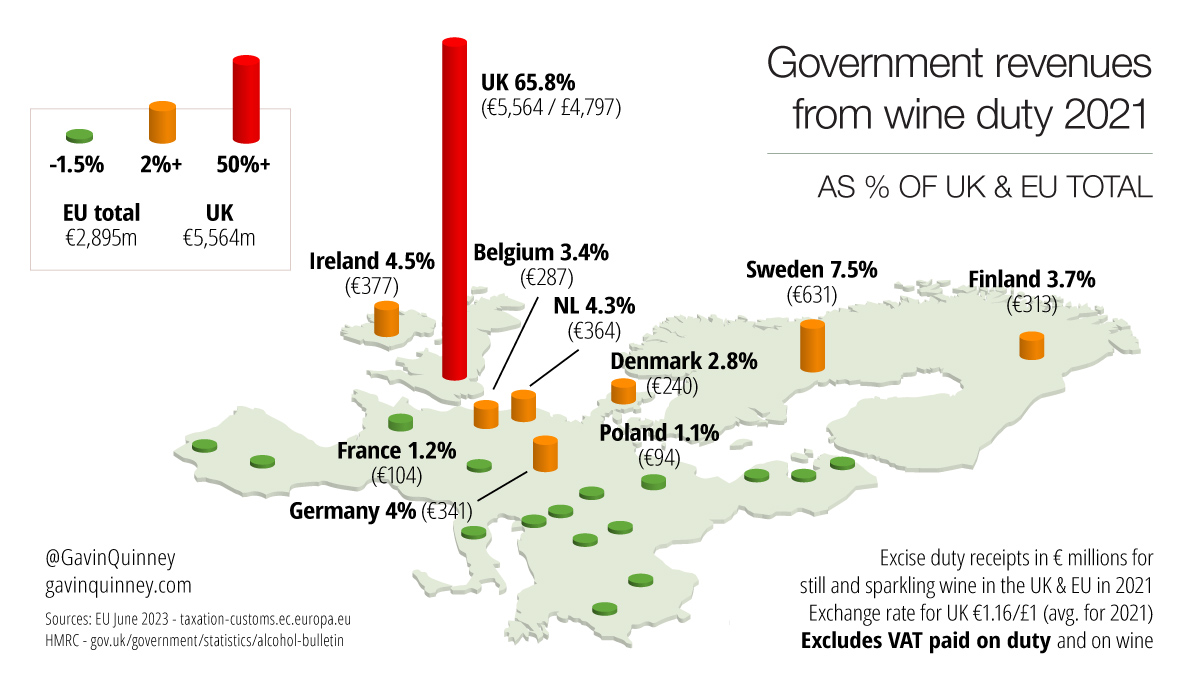

Which is odd, given that the UK extracted almost twice as much in wine duty in 2021 than all the countries in the EU put together, and there are now even higher and more complicated UK duties being launched.

Put another way, almost two thirds of all wine duty across the EU and UK combined was levied by the UK.

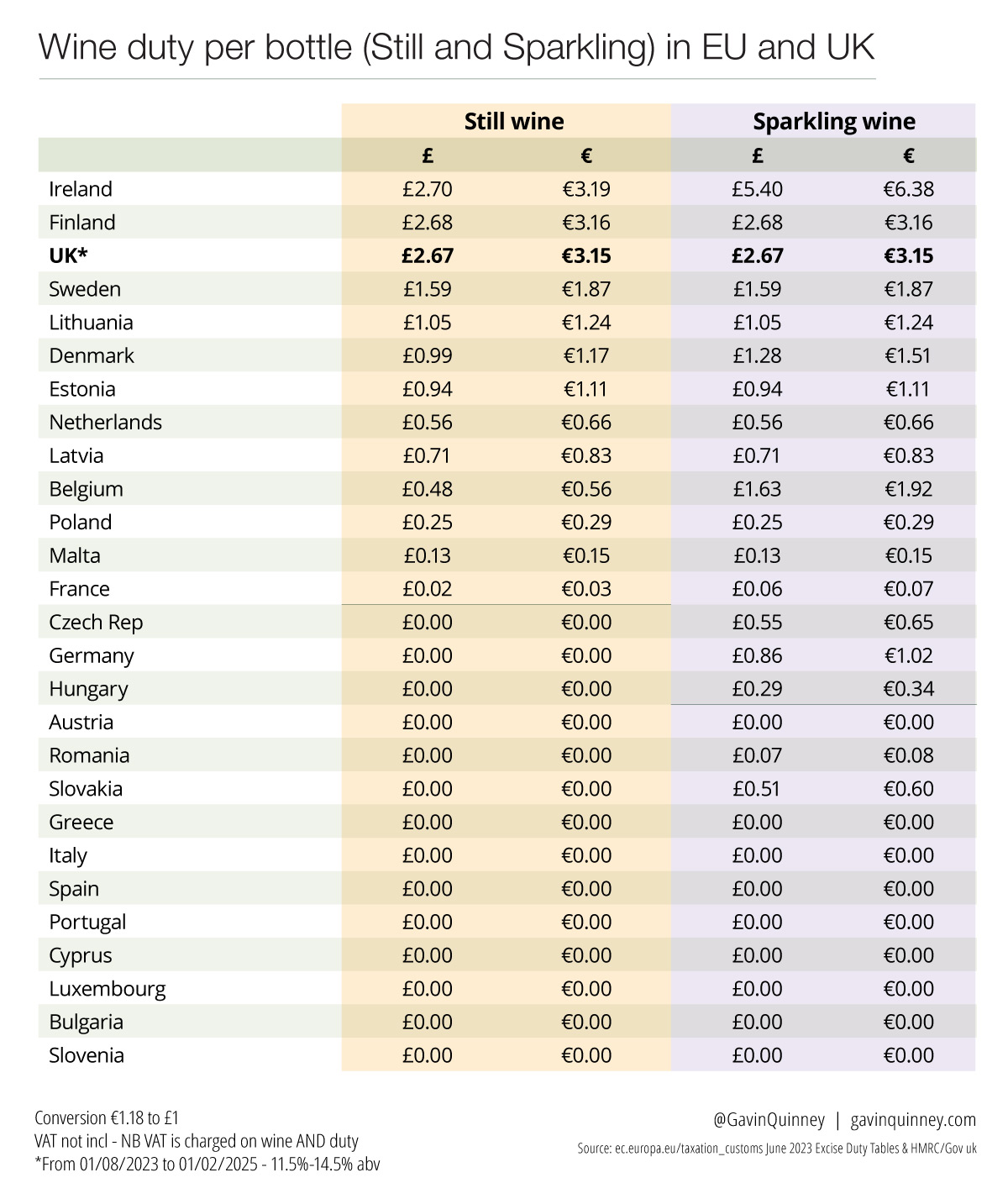

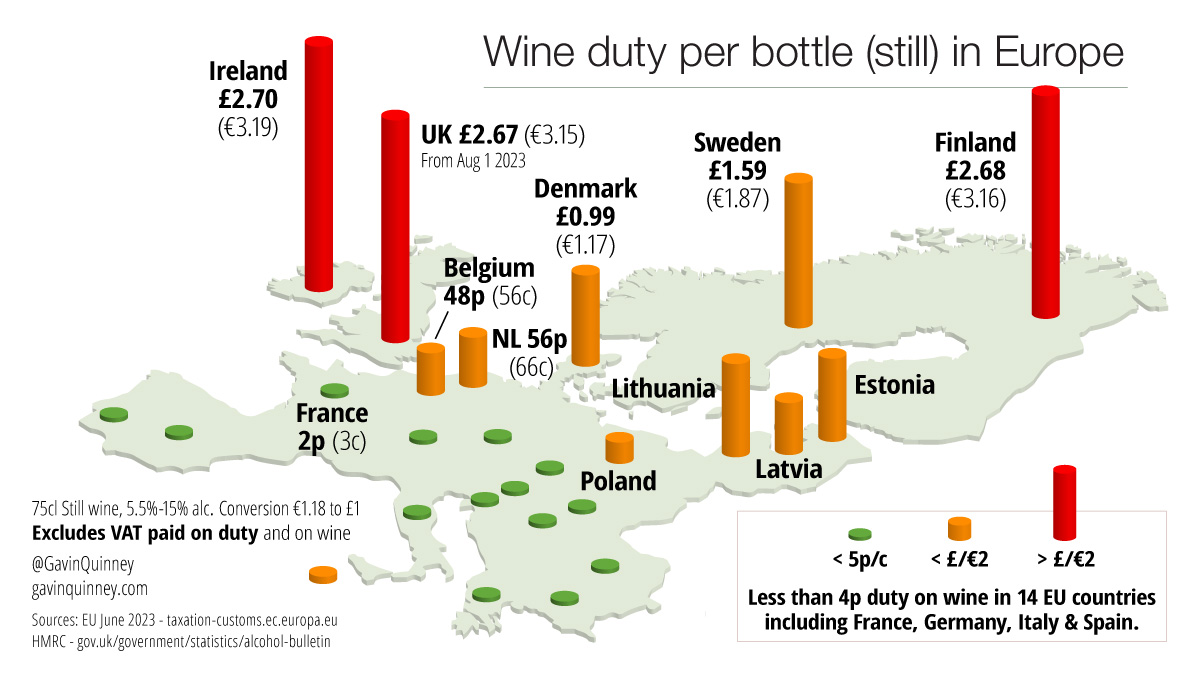

Equal highest duty on wine in Europe

The new duty rate of £2.67 takes the UK to within a whisker of Ireland at the top of the European duty leader board. In fact, if sterling reaches the heady clouds of €1.20 to the pound, then the UK would be top. A wine labelled at 15% vol will certainly be higher from August than anywhere on the continent at £3.21 duty (€3.72) plus VAT.

Pulling up the drawbridge

Sadly the option of popping over to France and picking up as much wine as you like for your own use – the duty in France being negligible – ended with Brexit at the start of 2021. The UK government opted for cutting the ‘unlimited’ amount you could bring back without paying UK duty to just 24 bottles of still, plus 12 bottles of sparkling wine (or 4 litres of spirits). And if you go over this allowance, then you have to pay UK duty on the whole lot, not just the excess.

If you want to see the old rules of what Brits could bring home from the EU, see the Gov.uk page for bringing wine into Northern Ireland. For the sad, post-Brexit alternative for coming across the channel, see ‘arriving in Great Britain’.

Never mind the major wine-producing countries, which are unlikely to tax their citizens heavily for a national product that they’re justifiably proud of. (VAT is deemed sufficient.) The UK will shortly have a duty rate on still wine that’s more than five times that of Belgium, and almost five times that of the Netherlands.

Worse is yet to come

Well, we’ve put together this table so I’m damned if we’re not going to use it. The full 27 bands of future UK wine duty in all their glory, which will replace the three current bands (in yellow). And as for policing it? Anyone been tasked with this?

Wine has taken a pasting like no other since we first came here for the 2000 growing season. Duty up by 138% dwarfs the other categories.

Appendix

An essential table to complete the picture – data faithfully collected and published as I couldn’t find it anywhere else. One day we too will be able to publish the total alcohol volume of wine sold, in millions of litres of pure alcohol. (Can’t wait.)

Onwards and upwards.